Simplified Issued Insurance

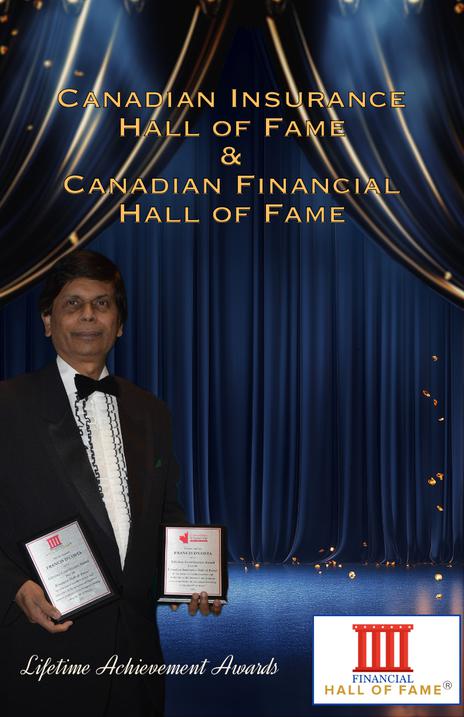

I believe that I should introduce myself before you read this understanding summary. I am Francis D'Costa, and I have been in this career for the last 34 years. This year I received Canadian Insurance Hall of Fame & Canadian Financial Hall of Fame Awards. I have also authored a book "Let not their Dreams Fade" which is currently #1 Most Gifted book on Amazon.

With all the advertisement appearing on social media citing $2 per week/day premium for insurance and giving examples of someone receiving million dollars is rather absurd. Hence, I have summarized below some hard core facts, which will not disappoint you when you check out the rates.

The purpose of this to give you the basic understanding of acquiring insurance for individuals who have medical concerns.

The rates I have shown are correct as of 20th of July 2025, based on an individual who can answers to the questions shown medical questions below.

The premium quoted are based on how you answer your health questions. That's understandable because the Insurance cannot give the same premium to individuals have medical concerns and to those who have no medical concerns.

Therefore there are a few companies who specialize in such simplified issued plans.

There are 2 types of plans i.e. Immediate Death Benefit and Deferred Death Benefit.

Highlights of the immediate death benefit plans:

Insurance coverage starts immediately and continues for life.

Premium is payable for life.

There are cash values accumulated but are negligible.

A Reduced paid up option is included.

Accidental Death Benefit is also included

If death occurs 200 km away from home than an additional amount of $2,000 will be added to your plan.

All death benefits are paid TAX FREE to your beneficiaries.

For example who would qualify:

If you have had a heart attack prior to 4 years than you qualify for immediate coverage. Or if you currently, have diabetes and the HC level is below 8.5 than you qualify for immediate coverage. The maximum amount you could purchase insurance coverage up to $350,000 from ages 40-65. And if you are 65-80 than it drops down to $50,000. Please note that whatever insurance you purchase will continue for life and will not reduce.

Some additional achievements

- Member of the MDRT (Million Dollar Round Table for 25 years

- 2 Years TOP of the Table

- 7 Years Court of the Table

- Moderator for Life Underwriters of Toronto for 13 Semesters

- Chairman of the MDRT Toronto - Chairman of MDRT Ontario